Navigating the Rural Landscape: A Comprehensive Guide to USDA Loan Zones

Related Articles: Navigating the Rural Landscape: A Comprehensive Guide to USDA Loan Zones

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Rural Landscape: A Comprehensive Guide to USDA Loan Zones. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Rural Landscape: A Comprehensive Guide to USDA Loan Zones

- 2 Introduction

- 3 Navigating the Rural Landscape: A Comprehensive Guide to USDA Loan Zones

- 3.1 Understanding the USDA Loan Zones Map: A Visual Guide to Eligibility

- 3.2 The Importance of the USDA Loan Zones Map: A Gateway to Rural Homeownership

- 3.3 Navigating the USDA Loan Zones Map: A Practical Guide for Homebuyers

- 3.4 Frequently Asked Questions about the USDA Loan Zones Map:

- 3.5 Tips for Utilizing the USDA Loan Zones Map Effectively:

- 3.6 Conclusion:

- 4 Closure

Navigating the Rural Landscape: A Comprehensive Guide to USDA Loan Zones

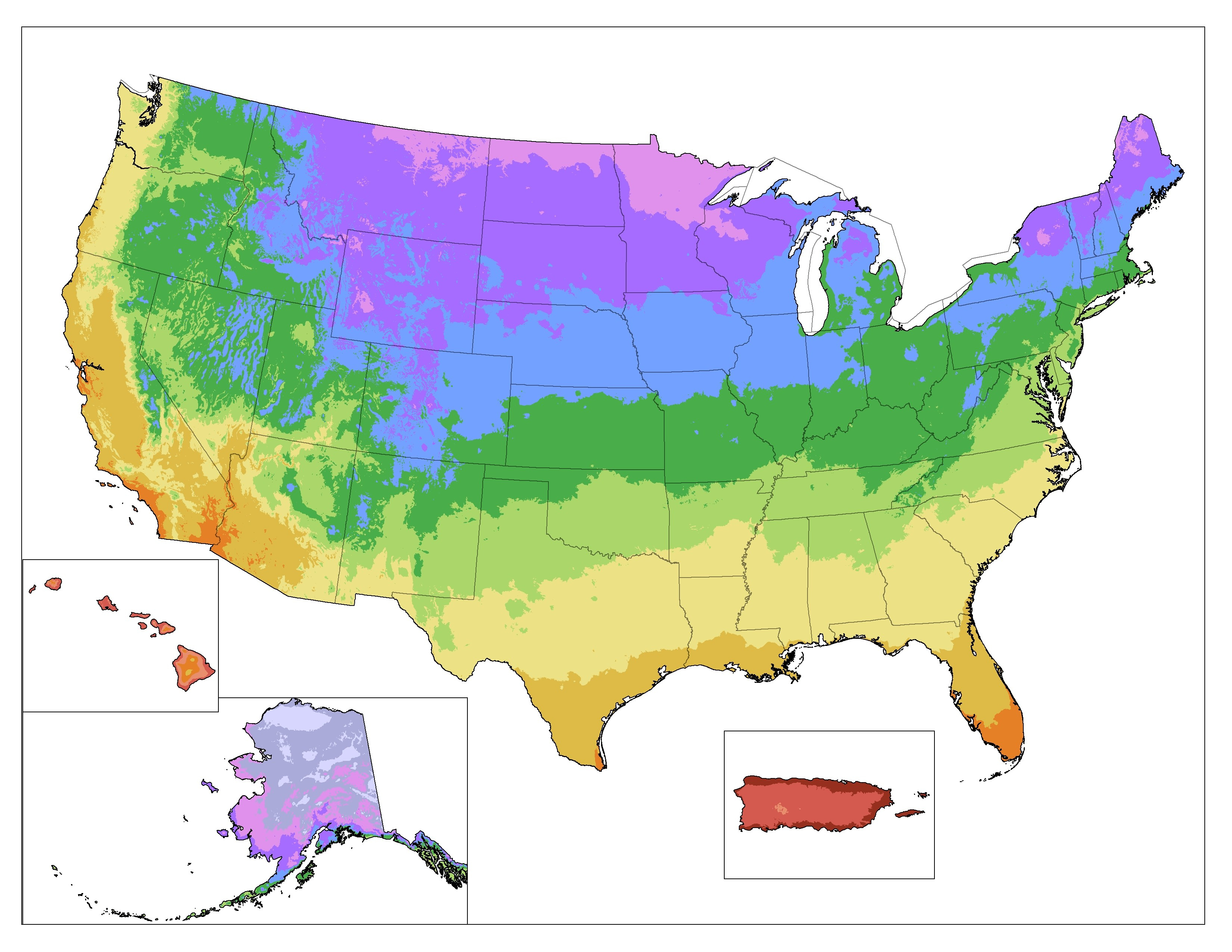

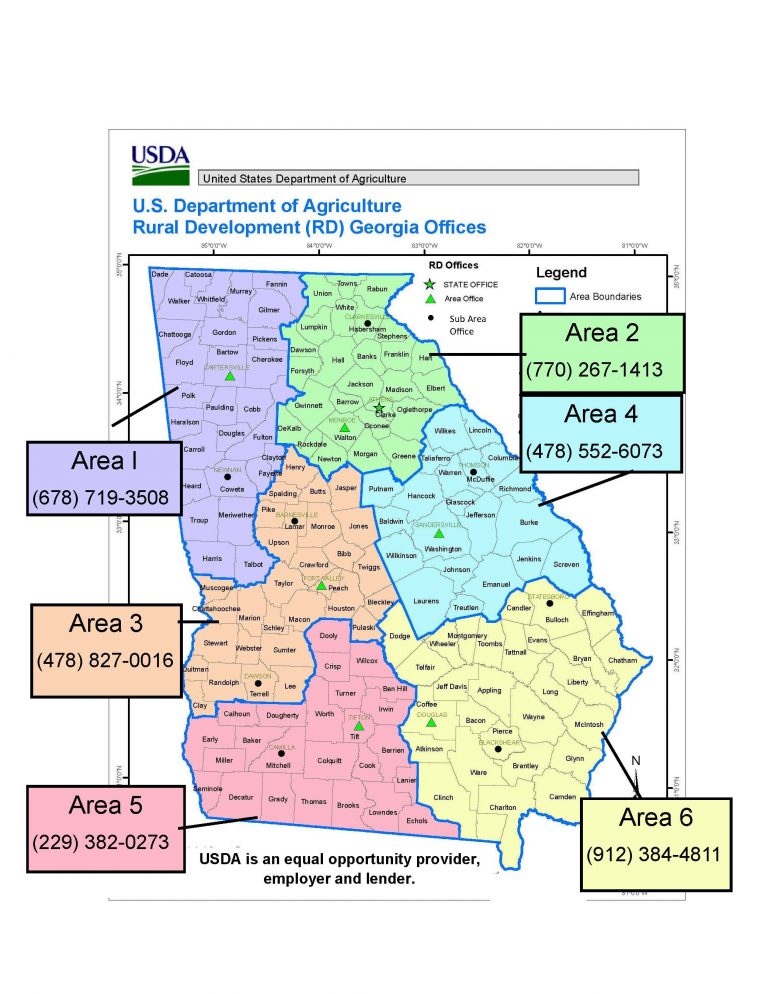

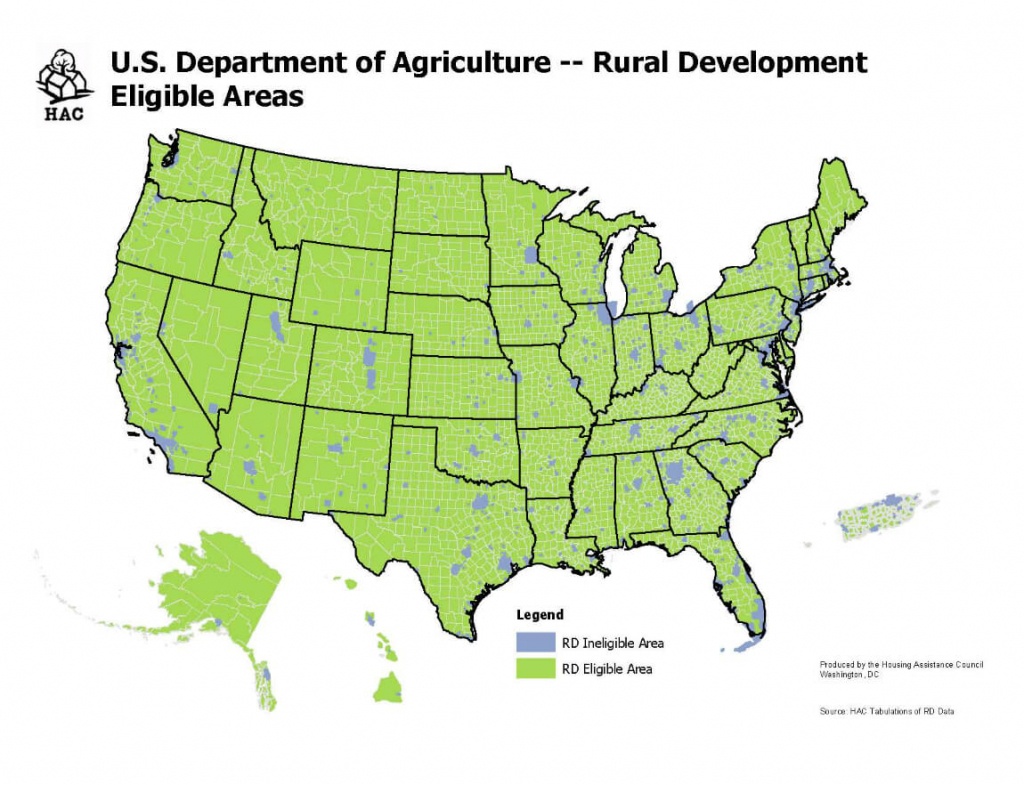

The United States Department of Agriculture (USDA) Rural Development program offers a range of financial assistance options for individuals and families seeking to purchase, build, or improve their homes in rural areas. A crucial component of this program is the USDA Loan Zones Map, which delineates eligible areas for USDA loan assistance. This map serves as a vital tool for prospective homebuyers, providing clarity and guidance on their eligibility for these beneficial programs.

Understanding the USDA Loan Zones Map: A Visual Guide to Eligibility

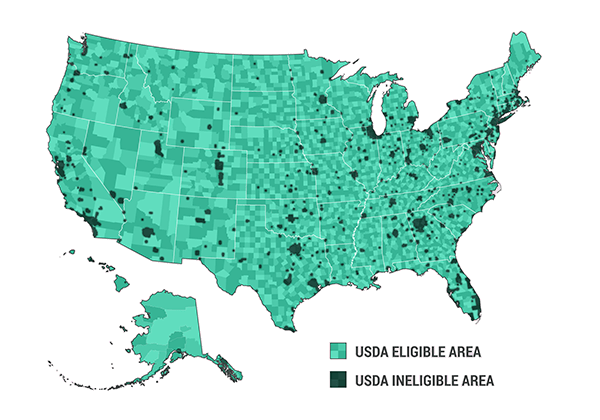

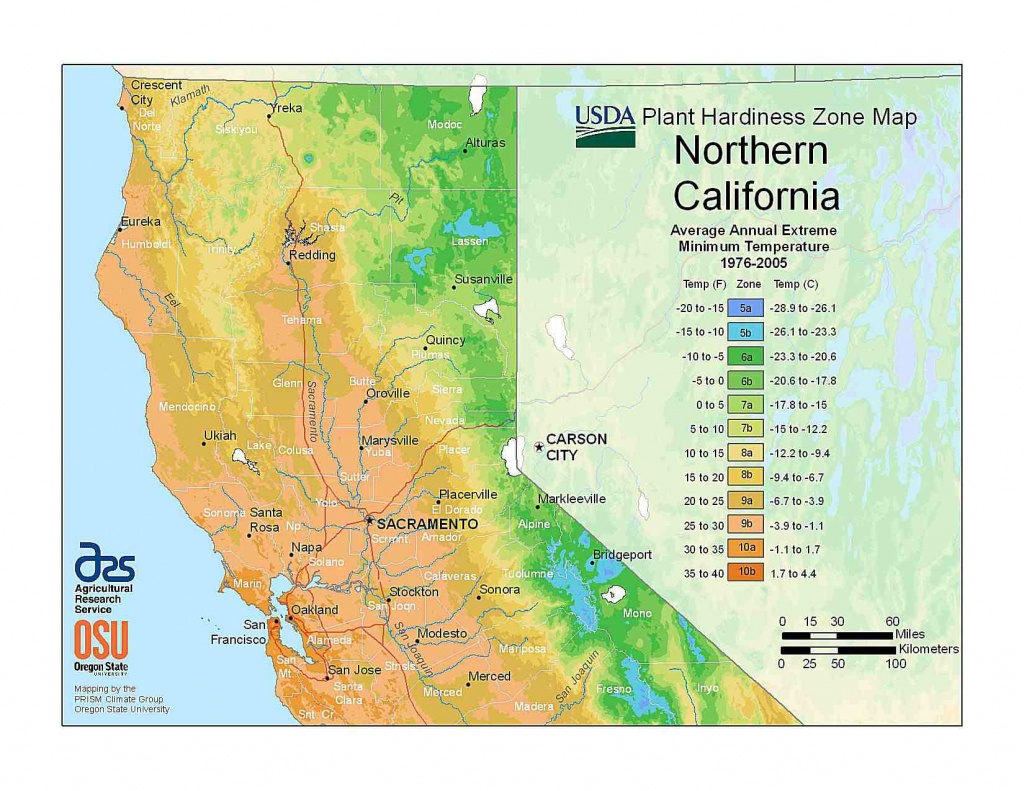

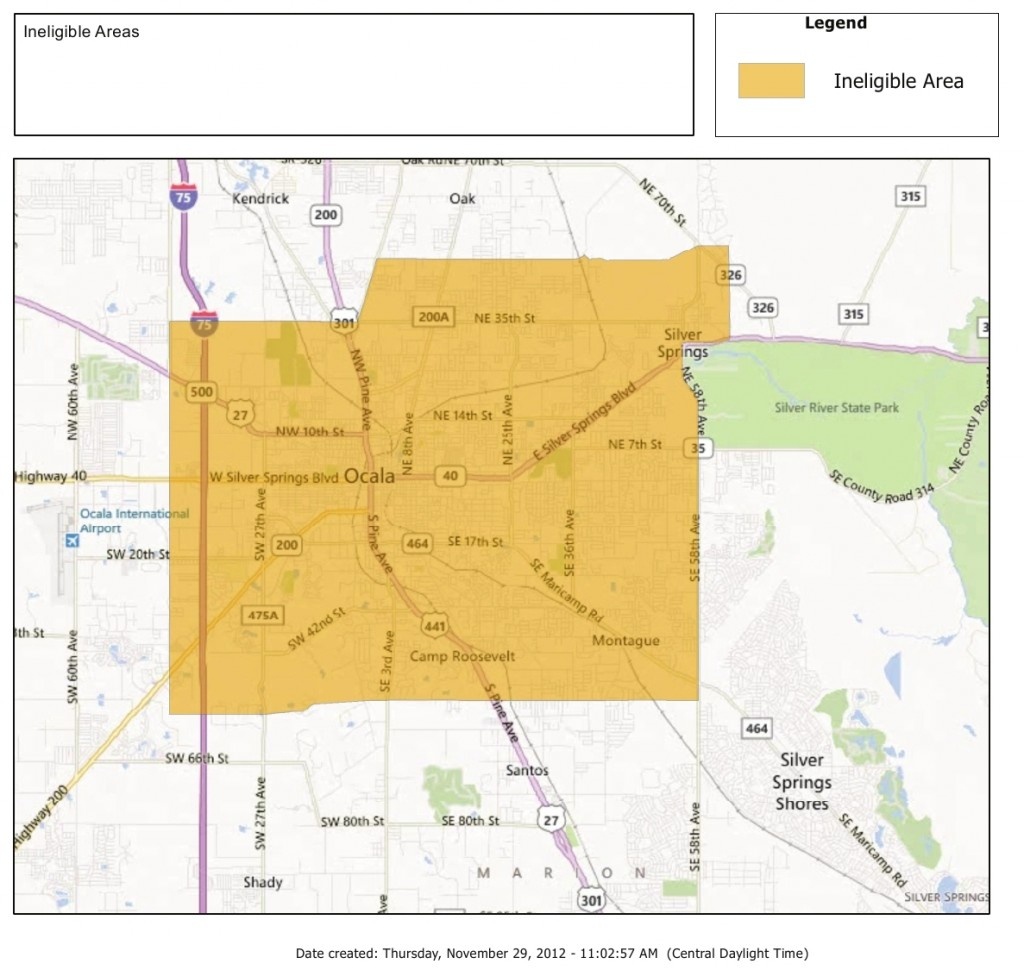

The USDA Loan Zones Map is a visual representation of geographical areas categorized into specific zones based on population density and other economic factors. This map is crucial for determining eligibility for USDA loan programs, particularly the Rural Housing Service (RHS), which offers low-interest, fixed-rate loans to eligible borrowers in rural areas.

Zone 1 encompasses areas with the highest population density and is typically ineligible for USDA loan programs. These areas often have access to conventional financing options, making them less reliant on USDA assistance.

Zone 2 encompasses areas with moderate population density and is generally eligible for USDA loan programs. These areas may experience some challenges in accessing conventional financing, making USDA loans a valuable option for homebuyers.

Zone 3 encompasses areas with the lowest population density and is typically eligible for USDA loan programs. These areas often lack access to conventional financing, making USDA loans a crucial lifeline for individuals and families seeking to purchase homes in these remote regions.

The USDA Loan Zones Map is dynamic, with updates occurring periodically to reflect changes in population density and economic conditions. This ensures that the map remains an accurate and reliable resource for homebuyers seeking USDA loan assistance.

The Importance of the USDA Loan Zones Map: A Gateway to Rural Homeownership

The USDA Loan Zones Map plays a pivotal role in facilitating homeownership in rural areas. It provides a transparent and accessible framework for determining eligibility for USDA loan programs, empowering prospective homebuyers to make informed decisions.

Benefits of Utilizing the USDA Loan Zones Map:

- Clarifies Eligibility: The map clearly identifies eligible areas, eliminating uncertainty and allowing individuals to focus their efforts on properties located within eligible zones.

- Reduces Financial Barriers: USDA loans offer low-interest rates and flexible terms, making homeownership more attainable for individuals and families who might otherwise face financial challenges.

- Promotes Rural Development: By facilitating homeownership in rural areas, USDA loans contribute to the economic growth and vitality of these communities.

- Offers a Path to Stability: USDA loans provide a pathway to financial stability for individuals and families, fostering a sense of belonging and community involvement.

Navigating the USDA Loan Zones Map: A Practical Guide for Homebuyers

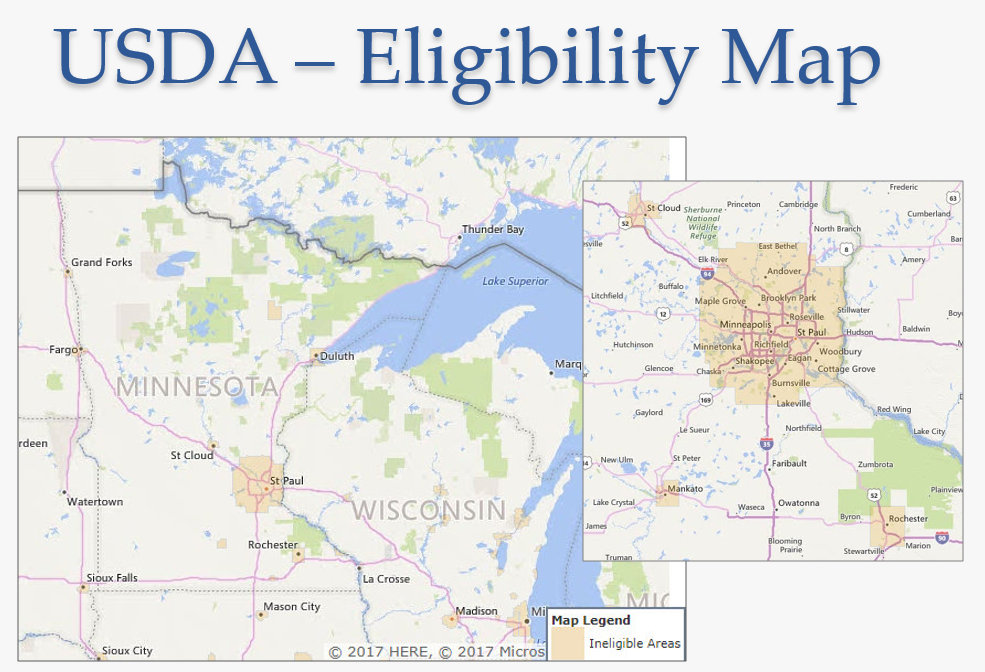

The USDA Loan Zones Map can be accessed online through the USDA Rural Development website or through various third-party resources. To effectively utilize this map, prospective homebuyers should follow these steps:

- Identify Your Desired Location: Begin by pinpointing the specific area where you wish to purchase a home. This could be a town, county, or even a specific neighborhood.

- Locate Your Desired Location on the Map: Once you have identified your desired location, use the USDA Loan Zones Map to determine the corresponding zone.

- Verify Eligibility: If your desired location falls within Zone 2 or Zone 3, you are generally eligible for USDA loan programs. However, it is crucial to verify your specific eligibility with a qualified lender.

- Explore Loan Options: Once eligibility is confirmed, explore the different USDA loan programs available, considering factors such as loan amount, interest rates, and repayment terms.

- Consult with a Lender: Engage with a qualified lender specializing in USDA loans to discuss your financial situation, loan options, and the application process.

Frequently Asked Questions about the USDA Loan Zones Map:

Q: How often is the USDA Loan Zones Map updated?

A: The USDA Loan Zones Map is updated periodically, typically every few years, to reflect changes in population density and economic conditions. It is recommended to check the USDA Rural Development website for the latest updates.

Q: Can I still qualify for a USDA loan if my desired location is in Zone 1?

A: While Zone 1 areas are typically ineligible for USDA loan programs, there may be exceptions. Some areas within Zone 1 might be eligible if they meet specific criteria related to population density and economic hardship. It is crucial to consult with a qualified lender to determine your specific eligibility.

Q: What are the income limits for USDA loan programs?

A: USDA loan programs have income limits based on household size and location. These limits vary by county and are designed to ensure that loans are available to low- and moderate-income individuals and families.

Q: What are the other eligibility requirements for USDA loans?

A: In addition to location and income requirements, there are other eligibility criteria for USDA loans, including:

- Creditworthiness: Borrowers must have a satisfactory credit history.

- Debt-to-income ratio: Borrowers must have a manageable debt-to-income ratio.

- Ability to repay: Borrowers must demonstrate the ability to repay the loan based on their income and expenses.

Q: What are the benefits of purchasing a home in a USDA loan zone?

A: Purchasing a home in a USDA loan zone offers several benefits, including:

- Access to affordable financing: USDA loans offer low-interest rates and flexible terms, making homeownership more attainable.

- Rural living: USDA loan zones often encompass beautiful and tranquil rural areas, providing a peaceful and serene lifestyle.

- Community involvement: Rural communities often foster a strong sense of community, offering opportunities for social interaction and engagement.

Tips for Utilizing the USDA Loan Zones Map Effectively:

- Consult with a Real Estate Agent: Engage with a real estate agent familiar with USDA loan programs and eligible areas to assist with property searches.

- Explore Different Areas: Don’t limit your search to just one area. Explore different USDA loan zones to discover a variety of options that meet your needs and preferences.

- Consider Future Growth: When choosing a location, consider the potential for future growth and development in the area, as this can impact property values and affordability.

- Research Local Amenities: Before making a decision, research the local amenities available in the area, such as schools, healthcare facilities, and recreational opportunities.

Conclusion:

The USDA Loan Zones Map serves as a valuable resource for individuals and families seeking to purchase homes in rural areas. By understanding the map’s functionality and utilizing it effectively, prospective homebuyers can navigate the rural landscape, identify eligible areas, and unlock the benefits of USDA loan programs. This map empowers individuals to make informed decisions, promoting rural development and fostering a sense of community and belonging. As the USDA continues to refine its loan programs and eligibility criteria, the USDA Loan Zones Map will remain an essential tool for navigating the path to rural homeownership.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Rural Landscape: A Comprehensive Guide to USDA Loan Zones. We hope you find this article informative and beneficial. See you in our next article!