Navigating the USDA Loan Eligibility Map in Georgia: A Comprehensive Guide for Rural Homebuyers

Related Articles: Navigating the USDA Loan Eligibility Map in Georgia: A Comprehensive Guide for Rural Homebuyers

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the USDA Loan Eligibility Map in Georgia: A Comprehensive Guide for Rural Homebuyers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the USDA Loan Eligibility Map in Georgia: A Comprehensive Guide for Rural Homebuyers

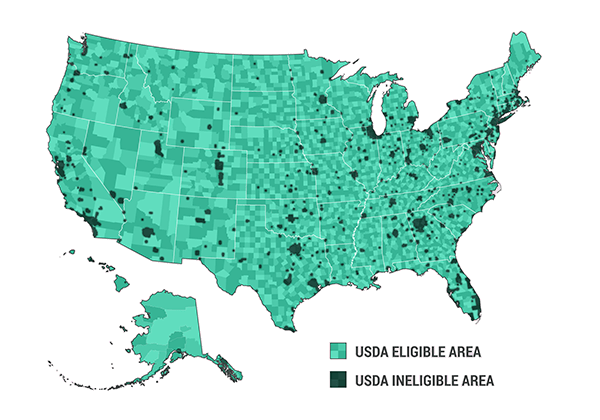

The USDA Rural Development program offers a unique opportunity for eligible individuals to achieve homeownership in rural areas. This program, through its Rural Housing Service (RHS), provides government-backed loans with favorable terms, including low interest rates and down payment assistance. However, eligibility for these loans is determined by geographic location, falling under the USDA’s definition of "rural." This guide provides a comprehensive overview of the USDA loan eligibility map in Georgia, outlining the criteria, benefits, and resources available to potential borrowers.

Understanding the USDA’s Definition of "Rural"

The USDA’s definition of "rural" extends beyond the traditional perception of remote, isolated areas. It encompasses a broader range of geographic locations, including towns and communities that meet specific criteria. The USDA uses a sophisticated mapping system to define eligible areas based on factors like population density, proximity to urban areas, and economic indicators.

The Importance of the USDA Loan Eligibility Map

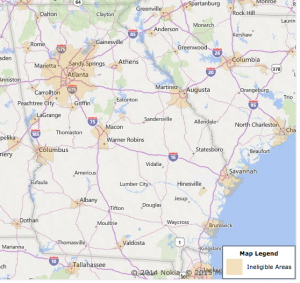

The USDA loan eligibility map is a crucial tool for prospective homebuyers in Georgia. It provides a clear visual representation of areas where USDA loans are available. This allows individuals to determine if their desired location qualifies for the program before initiating the loan application process.

Exploring the USDA Loan Eligibility Map in Georgia

The USDA’s website offers an interactive map tool that allows users to explore eligible areas in Georgia. This tool provides detailed information about each location, including the specific eligibility criteria and any applicable loan limits.

Factors Determining USDA Loan Eligibility

While the USDA loan eligibility map provides a general overview, several other factors determine loan eligibility:

- Income Limits: The USDA program has income limits based on household size and location. These limits ensure that the loan program benefits those with moderate to low incomes who may face challenges accessing conventional financing.

- Property Type: USDA loans are primarily intended for single-family homes. However, they can also be used for multi-family homes, manufactured homes, and even rural properties with existing structures that require rehabilitation.

- Credit Score: While the USDA program has more lenient credit score requirements compared to conventional loans, a good credit history is still essential for approval.

- Debt-to-Income Ratio: The USDA program considers the borrower’s debt-to-income ratio, which reflects the percentage of their income dedicated to debt payments.

Benefits of USDA Loans in Georgia

USDA loans offer significant advantages for qualified borrowers in Georgia:

- Low Interest Rates: USDA loans typically offer competitive interest rates, often lower than conventional mortgages. This translates into lower monthly payments and significant savings over the life of the loan.

- Down Payment Assistance: The USDA program provides down payment assistance, which can significantly reduce the upfront cost of homeownership. This makes homeownership more accessible to individuals who may not have the traditional 20% down payment required for conventional loans.

- Flexible Loan Terms: USDA loans offer flexible terms, allowing borrowers to choose a loan term that best suits their financial situation.

- No Private Mortgage Insurance (PMI): Unlike conventional loans, USDA loans do not require private mortgage insurance (PMI), which is an additional cost for borrowers with lower down payments.

- Focus on Rural Development: By providing affordable financing options in rural areas, USDA loans contribute to economic growth and community development.

Steps to Utilize the USDA Loan Eligibility Map in Georgia

- Explore the USDA’s Interactive Map: Begin by visiting the USDA Rural Development website and using the interactive map tool to identify eligible areas in Georgia.

- Research Specific Locations: Once you have identified potential locations, conduct further research to understand the local market, property values, and community amenities.

- Contact a USDA-Approved Lender: Consult with a USDA-approved lender to discuss your eligibility and loan options.

- Gather Required Documentation: Be prepared to provide the necessary documentation, including income verification, credit history, and property information.

- Submit Your Loan Application: Complete and submit your loan application to the USDA-approved lender.

Frequently Asked Questions (FAQs) about USDA Loan Eligibility in Georgia

Q: What are the income limits for USDA loans in Georgia?

A: Income limits vary based on household size and location. It is best to consult with a USDA-approved lender or refer to the USDA’s website for the most up-to-date information.

Q: Can I use a USDA loan to purchase a property in a town or city?

A: While USDA loans are primarily targeted for rural areas, some towns and cities may qualify. The USDA’s interactive map tool can provide clarity on specific locations.

Q: What are the credit score requirements for a USDA loan?

A: While the USDA program has more lenient credit score requirements than conventional loans, a good credit history is still essential for approval. Consult with a USDA-approved lender for specific requirements.

Q: How much down payment assistance is available with a USDA loan?

A: The USDA program offers down payment assistance, which can vary based on the specific loan program and your individual circumstances. Contact a USDA-approved lender for details.

Q: Can I use a USDA loan to purchase a second home or investment property?

A: USDA loans are primarily intended for primary residences. However, there are exceptions for multi-family homes, where one unit can be used as a primary residence and the other as a rental property.

Tips for Utilizing the USDA Loan Eligibility Map in Georgia

- Consult with a Local Real Estate Agent: A local real estate agent familiar with USDA loans can provide valuable insights into eligible areas and available properties.

- Compare Loan Options: Contact multiple USDA-approved lenders to compare interest rates, fees, and loan terms.

- Review Loan Documents Carefully: Thoroughly read and understand all loan documents before signing.

- Seek Professional Financial Advice: Consult with a financial advisor to ensure that a USDA loan aligns with your overall financial goals.

Conclusion

The USDA loan eligibility map in Georgia serves as an invaluable resource for individuals seeking affordable homeownership in rural areas. By understanding the program’s criteria, benefits, and resources, prospective borrowers can navigate the process effectively and make informed decisions about their homeownership journey. Utilizing the USDA’s interactive map tool, consulting with USDA-approved lenders, and seeking professional guidance can significantly enhance the likelihood of success in securing a USDA loan.

Closure

Thus, we hope this article has provided valuable insights into Navigating the USDA Loan Eligibility Map in Georgia: A Comprehensive Guide for Rural Homebuyers. We hope you find this article informative and beneficial. See you in our next article!