Navigating the World of Payments: A Comprehensive Guide to Digital Financial Services

Related Articles: Navigating the World of Payments: A Comprehensive Guide to Digital Financial Services

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the World of Payments: A Comprehensive Guide to Digital Financial Services. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the World of Payments: A Comprehensive Guide to Digital Financial Services

- 2 Introduction

- 3 Navigating the World of Payments: A Comprehensive Guide to Digital Financial Services

- 3.1 The Evolution of Payment Systems

- 3.2 Map Pago Pago: A Comprehensive Digital Financial Platform

- 3.3 Benefits of Using Map Pago Pago

- 3.4 How Map Pago Pago Works: A Step-by-Step Guide

- 3.5 Map Pago Pago: A Catalyst for Financial Innovation

- 3.6 Frequently Asked Questions (FAQs)

- 3.7 Tips for Using Map Pago Pago Effectively

- 3.8 Conclusion

- 4 Closure

Navigating the World of Payments: A Comprehensive Guide to Digital Financial Services

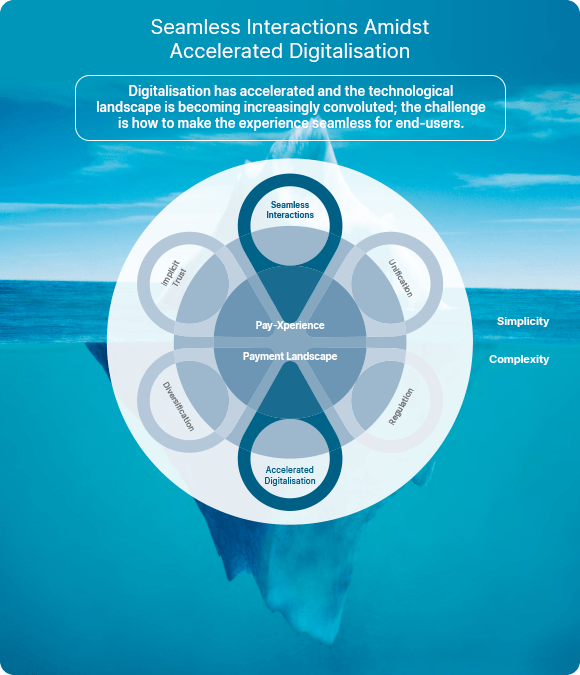

In today’s increasingly interconnected world, the need for secure and convenient payment methods has become paramount. Traditional banking systems, while reliable, often fall short in meeting the demands of a digitally driven society. This is where digital financial services, often referred to as "digital wallets" or "mobile money," emerge as a vital solution. These platforms facilitate seamless transactions, enabling individuals and businesses alike to manage their finances with greater efficiency and flexibility.

One such prominent player in the digital financial services landscape is Map Pago Pago, a platform designed to revolutionize the way people interact with money. This comprehensive guide delves into the intricacies of Map Pago Pago, outlining its features, benefits, and impact on modern financial practices.

The Evolution of Payment Systems

Before exploring the intricacies of Map Pago Pago, it is essential to understand the broader context of payment systems and their evolution. Traditionally, cash was the dominant form of payment, requiring physical exchange and posing challenges in terms of security and convenience. The advent of credit cards and debit cards introduced a new level of convenience, but these systems still relied on physical cards and associated infrastructure.

The rise of the internet and mobile technology ushered in a new era of digital payments. Online banking platforms and digital wallets emerged, enabling transactions to be conducted remotely and securely. These platforms have become increasingly sophisticated, offering a wide range of functionalities, including:

- Account Management: Users can access their accounts, check balances, and manage transactions online or via mobile apps.

- Bill Payments: Bills can be paid directly from digital wallets, eliminating the need for physical checks or trips to payment centers.

- Money Transfers: Funds can be transferred between accounts quickly and securely, often with lower fees compared to traditional bank transfers.

- Mobile Payments: Digital wallets can be linked to mobile devices, enabling contactless payments at physical stores and online.

- Investments and Savings: Some platforms offer investment and savings options, allowing users to grow their money through various financial instruments.

Map Pago Pago: A Comprehensive Digital Financial Platform

Map Pago Pago stands out as a comprehensive digital financial platform that encompasses a wide range of services designed to cater to the diverse needs of individuals and businesses. Its key features include:

- Secure Account Management: Map Pago Pago prioritizes user security by implementing robust encryption protocols and multi-factor authentication measures. Users can manage their accounts, track transactions, and set spending limits with ease.

- Versatile Payment Options: The platform supports multiple payment methods, including credit cards, debit cards, bank transfers, and mobile money, providing users with flexibility in choosing their preferred method.

- Global Reach: Map Pago Pago facilitates seamless cross-border transactions, enabling users to send and receive money internationally with competitive exchange rates.

- Merchant Integration: Businesses can integrate Map Pago Pago into their existing systems, offering their customers a convenient and secure payment option.

- Financial Inclusion: The platform aims to promote financial inclusion by providing access to financial services to underserved populations, including those without traditional bank accounts.

Benefits of Using Map Pago Pago

The benefits of using Map Pago Pago extend far beyond mere convenience. The platform empowers users with greater control over their finances, offering a range of advantages:

- Enhanced Security: By eliminating the need for physical cash or cards, Map Pago Pago significantly reduces the risk of theft or fraud. The platform’s robust security measures ensure that user data and financial information are protected.

- Improved Efficiency: Transactions can be completed quickly and easily, saving users time and effort compared to traditional payment methods. The platform’s user-friendly interface simplifies account management and financial tracking.

- Cost Savings: Map Pago Pago often offers lower transaction fees compared to traditional banks, making it a cost-effective solution for both individuals and businesses.

- Increased Convenience: Users can access their finances anytime, anywhere, through their mobile devices or computers. This flexibility allows for greater control over spending and financial planning.

- Financial Empowerment: Map Pago Pago provides users with access to a range of financial services, including loans, insurance, and investment options, empowering them to make informed financial decisions.

How Map Pago Pago Works: A Step-by-Step Guide

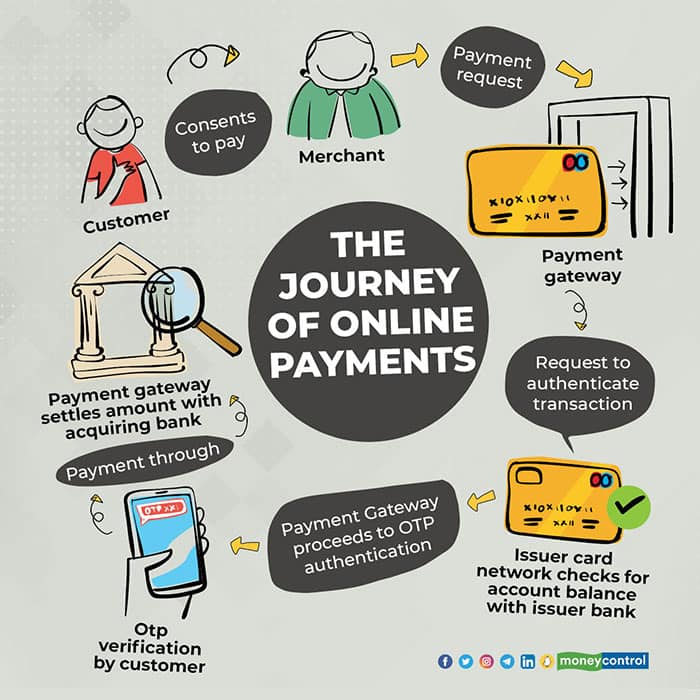

Using Map Pago Pago is a straightforward process. Here’s a step-by-step guide to help you get started:

- Account Creation: Download the Map Pago Pago app or visit the platform’s website to create an account. You will need to provide basic personal information and verify your identity.

- Funding Your Account: You can fund your Map Pago Pago account through various methods, including bank transfers, credit cards, or mobile money.

- Making Payments: To make a payment, simply enter the recipient’s details or scan a QR code. The platform will automatically deduct the funds from your account.

- Receiving Payments: You can receive payments from others by providing them with your Map Pago Pago account details or by generating a unique QR code.

- Managing Your Finances: The platform’s intuitive interface allows you to track your transactions, view your balance, and manage your spending. You can also set up alerts for low balances or unauthorized transactions.

Map Pago Pago: A Catalyst for Financial Innovation

Map Pago Pago is more than just a payment platform; it is a catalyst for financial innovation, driving positive change in the way people manage their finances. The platform’s focus on security, convenience, and affordability is making financial services more accessible to a wider audience.

By leveraging the power of technology, Map Pago Pago is helping to bridge the gap between traditional banking systems and the needs of a digitally connected world. The platform’s impact extends beyond individual users, fostering economic growth and financial inclusion by empowering businesses and communities.

Frequently Asked Questions (FAQs)

Q: Is Map Pago Pago secure?

A: Map Pago Pago prioritizes user security by implementing robust encryption protocols and multi-factor authentication measures. The platform also adheres to industry-standard security practices to protect user data and financial information.

Q: How can I contact Map Pago Pago customer support?

A: You can reach Map Pago Pago customer support through various channels, including phone, email, and live chat. The platform offers 24/7 support to address any queries or concerns.

Q: What are the fees associated with using Map Pago Pago?

A: Map Pago Pago charges competitive transaction fees, which vary depending on the payment method and transaction amount. The platform’s website provides detailed information on fees and charges.

Q: Can I use Map Pago Pago for international transactions?

A: Yes, Map Pago Pago supports cross-border transactions, enabling users to send and receive money internationally with competitive exchange rates.

Q: Is Map Pago Pago available in my country?

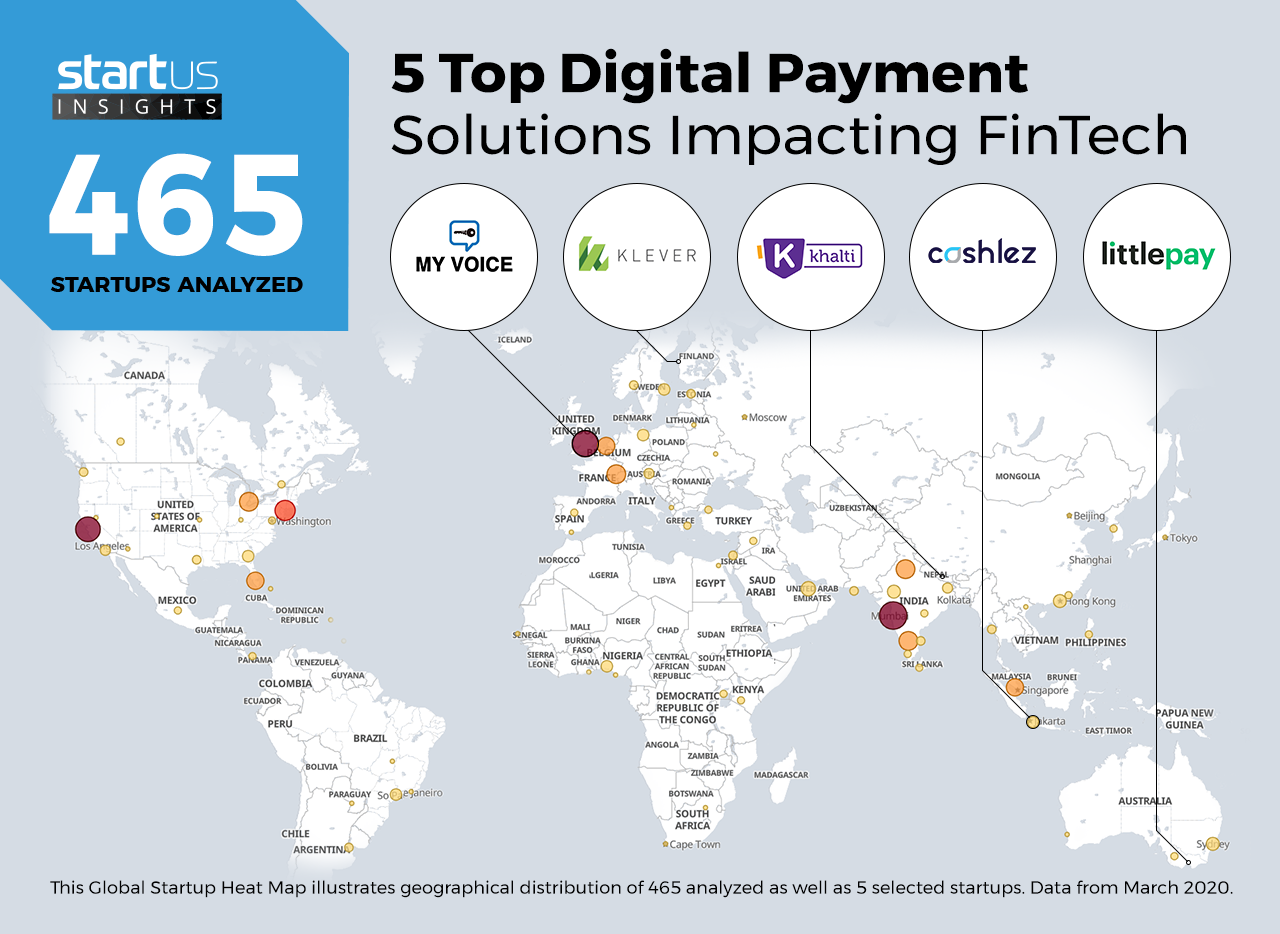

A: Map Pago Pago is currently available in a wide range of countries. The platform’s website provides information on its geographic reach and availability.

Tips for Using Map Pago Pago Effectively

To make the most of your Map Pago Pago experience, consider these tips:

- Enable Two-Factor Authentication: This extra layer of security significantly reduces the risk of unauthorized access to your account.

- Regularly Review Your Transaction History: This helps to identify any suspicious activity and ensure that your account is secure.

- Set Spending Limits: Setting limits on your spending can help you avoid overspending and manage your budget effectively.

- Take Advantage of Promotions and Offers: Map Pago Pago often runs promotions and offers that can save you money on transactions.

- Contact Customer Support for Assistance: If you have any questions or encounter any issues, don’t hesitate to reach out to Map Pago Pago’s customer support team.

Conclusion

Map Pago Pago represents a significant advancement in the field of digital financial services. The platform’s comprehensive suite of features, coupled with its commitment to security, convenience, and affordability, is transforming the way people interact with money. By empowering individuals and businesses with greater control over their finances, Map Pago Pago is driving positive change in the financial landscape, fostering economic growth and promoting financial inclusion. As technology continues to evolve, platforms like Map Pago Pago will play an increasingly vital role in shaping the future of financial services, paving the way for a more secure, convenient, and accessible financial ecosystem.

![[Infographic] What You Need to Know About Payments for Digital Business](https://fastspring.com/wp/wp-content/uploads/2018/09/online_payment_processing_infographic_fastspring.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Payments: A Comprehensive Guide to Digital Financial Services. We thank you for taking the time to read this article. See you in our next article!