Understanding Macon County’s Tax Map: A Comprehensive Guide

Related Articles: Understanding Macon County’s Tax Map: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding Macon County’s Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Understanding Macon County’s Tax Map: A Comprehensive Guide

- 2 Introduction

- 3 Understanding Macon County’s Tax Map: A Comprehensive Guide

- 3.1 The Importance of Macon County’s Tax Map

- 3.2 Navigating the Macon County Tax Map

- 3.3 Understanding Tax Map Terminology

- 3.4 Frequently Asked Questions (FAQs)

- 3.5 Tips for Using the Macon County Tax Map

- 3.6 Conclusion

- 4 Closure

Understanding Macon County’s Tax Map: A Comprehensive Guide

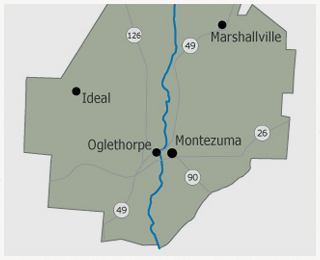

Macon County, like many other jurisdictions, utilizes a tax map to streamline its property tax assessment and collection process. This map, a vital tool for both the county government and its residents, serves as a visual representation of all taxable properties within the county, providing crucial information for various purposes.

The Importance of Macon County’s Tax Map

The Macon County tax map plays a critical role in ensuring fairness and transparency in property taxation. It provides a foundation for:

1. Accurate Property Assessment: The map serves as a visual reference for assessors, enabling them to accurately determine the value of each property based on factors like size, location, and improvements. This accurate assessment ensures that property owners pay their fair share of taxes, preventing discrepancies and promoting equity.

2. Efficient Tax Collection: The map facilitates the identification of property owners and their respective parcels, streamlining the process of sending tax bills and collecting payments. This efficiency minimizes administrative burdens and ensures timely revenue collection for essential county services.

3. Transparent Public Access: The tax map is readily accessible to the public, enabling residents to understand the tax structure and how their property is assessed. This transparency fosters trust and accountability, allowing citizens to verify the accuracy of assessments and participate in the tax process.

4. Property Planning and Development: The map provides valuable insights into property boundaries, zoning regulations, and potential development opportunities. This information is crucial for real estate professionals, developers, and individuals planning to purchase, sell, or develop property within the county.

5. Emergency Response and Disaster Planning: The map’s detailed information on property locations and infrastructure can be invaluable during emergencies and natural disasters. This data assists emergency responders in navigating the county, coordinating relief efforts, and ensuring the safety of residents.

Navigating the Macon County Tax Map

The Macon County tax map is typically accessible online through the county’s official website. It is often presented in a user-friendly format, allowing users to search for specific properties by address, parcel number, or owner name. The map may include various layers of information, such as:

- Parcel Boundaries: Clear outlines of each individual property within the county.

- Property Information: Details like address, ownership, acreage, and zoning designation.

- Tax Assessment Data: Current assessed value, tax rate, and outstanding tax payments.

- Infrastructure: Location of roads, utilities, and other public amenities.

- Historical Data: Records of past property transactions and assessments.

Understanding Tax Map Terminology

To fully comprehend the information presented on the Macon County tax map, it’s important to understand some key terms:

- Parcel: A specific piece of land identified by a unique number.

- Assessment: The estimated market value of a property for tax purposes.

- Tax Rate: The percentage used to calculate property taxes based on the assessed value.

- Tax Bill: A statement detailing the amount of taxes owed for a specific property.

- Exemption: A reduction in the assessed value of a property that may be granted based on factors like age, disability, or veteran status.

Frequently Asked Questions (FAQs)

1. How can I access the Macon County tax map?

The tax map is typically available on the Macon County website. Look for sections related to property taxes, assessors, or GIS (Geographic Information Systems).

2. How do I find my property on the tax map?

You can search for your property using your address, parcel number, or owner name. The map interface will usually provide a search bar or interactive tools to locate your property.

3. What information can I find on the tax map about my property?

The map will typically display your property’s boundaries, assessed value, tax rate, and any applicable exemptions. You may also find information about the property’s zoning, ownership history, and potential development restrictions.

4. Can I challenge my property assessment?

Yes, if you believe your property’s assessed value is inaccurate, you can file an appeal with the Macon County Assessor’s Office. The assessor will review your request and may adjust the assessment if warranted.

5. How do I pay my property taxes?

You will receive a tax bill from the Macon County Treasurer’s Office. You can pay your taxes online, by mail, or in person at the Treasurer’s office.

Tips for Using the Macon County Tax Map

- Familiarize yourself with the map interface: Explore the map’s features and tools to understand how to navigate and search for specific properties.

- Utilize the search functions: Use the address, parcel number, or owner name search to quickly locate your property or any other property of interest.

- Review the map layers: Explore the different layers of information to gain a comprehensive understanding of the data available.

- Consult the assessor’s office: If you have any questions or need clarification on the information presented on the map, contact the Macon County Assessor’s Office for assistance.

- Stay informed about tax updates: Subscribe to the county’s email alerts or newsletters to receive updates on tax rates, assessment changes, and other relevant information.

Conclusion

The Macon County tax map serves as a vital resource for both the county government and its residents. It facilitates accurate property assessment, efficient tax collection, transparent public access, and informed property planning. By understanding the information presented on the map and utilizing its features effectively, residents can navigate the tax process, protect their property rights, and contribute to the overall well-being of Macon County.

Closure

Thus, we hope this article has provided valuable insights into Understanding Macon County’s Tax Map: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!