Understanding the Power of Tax District Maps: A Comprehensive Guide

Related Articles: Understanding the Power of Tax District Maps: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the Power of Tax District Maps: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Understanding the Power of Tax District Maps: A Comprehensive Guide

- 2 Introduction

- 3 Understanding the Power of Tax District Maps: A Comprehensive Guide

- 3.1 Delving into the Concept of Tax Districts

- 3.2 The Importance of Tax District Maps

- 3.3 Navigating Tax District Maps: A Step-by-Step Guide

- 3.4 FAQs about Tax District Maps

- 3.5 Tips for Utilizing Tax District Maps

- 3.6 Conclusion: The Value of Visual Understanding

- 4 Closure

Understanding the Power of Tax District Maps: A Comprehensive Guide

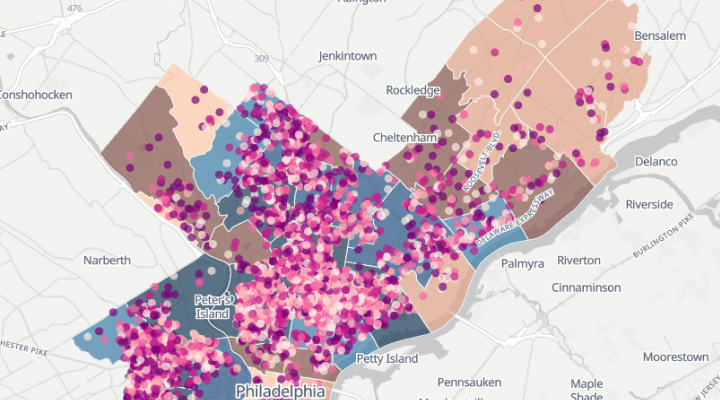

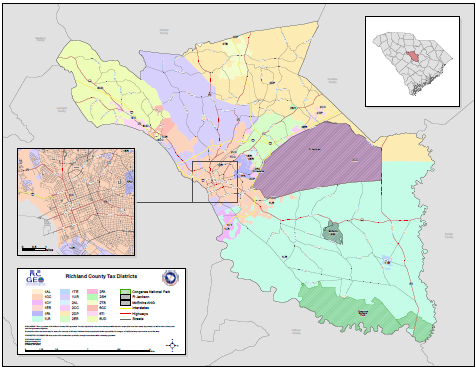

Tax district maps are essential tools for understanding the intricate web of taxation within a region. They provide a visual representation of how geographical areas are divided for the purpose of levying and collecting taxes. These maps are invaluable resources for individuals, businesses, and policymakers alike, offering insights into the financial landscape of a community and facilitating informed decision-making.

Delving into the Concept of Tax Districts

Tax districts are specific geographical areas defined by government entities for the purpose of administering and collecting taxes. These districts can be based on various factors, including:

- Administrative Boundaries: Municipal boundaries, county lines, and school district borders often serve as the basis for tax district delineation.

- Service Provision: Districts might be created to reflect the provision of specific services like fire protection, water management, or public transportation, with taxes levied to fund these services.

- Tax Rates: Different tax rates may apply to different districts based on factors like property value, income levels, or the type of service provided.

The Importance of Tax District Maps

Tax district maps serve as a critical tool for understanding the following:

- Property Tax Rates: By overlaying property tax rates on a map, individuals and businesses can readily identify the tax burden associated with different locations. This information is crucial for real estate transactions, investment decisions, and property planning.

- Service Area Coverage: Tax district maps clearly show the boundaries of service areas for various public amenities. This allows residents to understand the services they are entitled to and the corresponding tax implications.

- Tax Revenue Distribution: Maps can illustrate how tax revenue is collected and distributed across different districts. This information is essential for policymakers to assess the equity and efficiency of tax systems and make informed decisions regarding resource allocation.

- Public Policy Analysis: Tax district maps provide valuable data for analyzing the impact of various public policies on different communities. This can inform policy decisions related to zoning, infrastructure development, and social services.

- Community Development: Understanding tax district boundaries and associated revenue streams can assist in community development initiatives, allowing for targeted investment and resource allocation based on local needs.

Navigating Tax District Maps: A Step-by-Step Guide

- Identify the Source: Tax district maps can be accessed from various sources, including government websites, real estate websites, and mapping platforms. Ensure the source is reputable and provides up-to-date information.

- Understand the Legend: Each map will have a legend explaining the different colors, symbols, and abbreviations used to represent various tax districts and their associated information.

- Locate the Area of Interest: Focus on the specific area you are interested in, whether it’s a particular neighborhood, municipality, or a wider region.

- Interpret the Data: Use the map’s legend to understand the tax rates, service areas, or other relevant data displayed for each tax district.

- Compare and Contrast: Analyze the differences in tax rates, service provision, and other factors across different districts to gain a comprehensive understanding of the tax landscape.

FAQs about Tax District Maps

Q: Where can I find tax district maps for my area?

A: Tax district maps are typically available on the websites of local government agencies, including municipalities, counties, and school districts. Real estate websites and mapping platforms like Google Maps may also provide this information.

Q: What types of information are typically included on tax district maps?

A: Tax district maps often include information about:

- Tax district boundaries: Clearly defined lines representing the geographical limits of each tax district.

- Tax rates: The specific tax rates applicable to each district, often displayed as color gradients or numerical values.

- Service areas: Areas covered by specific services like fire protection, water management, or public transportation.

- Property values: Average property values within each district, which can influence tax rates.

Q: How can I use a tax district map to make informed real estate decisions?

A: Tax district maps can help you identify areas with favorable tax rates and service provision, which can impact property values and overall living costs. This information is crucial for making informed decisions about buying, selling, or renting property.

Q: Are tax district maps updated regularly?

A: Tax district maps are typically updated periodically, often coinciding with changes in tax rates, service provision, or administrative boundaries. Check the map source for the latest update date to ensure you are using accurate information.

Q: Can I use a tax district map to estimate my property taxes?

A: While tax district maps can provide an overview of tax rates, estimating your specific property taxes requires additional information like your property’s assessed value and any applicable exemptions.

Tips for Utilizing Tax District Maps

- Compare multiple sources: Consult different sources for tax district maps to ensure accuracy and consistency.

- Consider the time frame: Pay attention to the date of the map to ensure you are using up-to-date information.

- Use the legend carefully: Thoroughly understand the legend to interpret the data displayed on the map correctly.

- Seek professional guidance: If you need specific advice on tax implications, consult a tax professional or real estate agent.

Conclusion: The Value of Visual Understanding

Tax district maps provide a valuable visual tool for understanding the intricate workings of taxation within a region. They empower individuals, businesses, and policymakers with the information needed to make informed decisions, analyze trends, and advocate for equitable and efficient tax systems. By understanding the nuances of tax districts and utilizing these maps effectively, we can navigate the financial landscape with greater clarity and contribute to the well-being of our communities.

-d4c7-6714.jpg)

Closure

Thus, we hope this article has provided valuable insights into Understanding the Power of Tax District Maps: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!