Unlocking the Secrets of Glynn County: A Comprehensive Guide to the Tax Map

Related Articles: Unlocking the Secrets of Glynn County: A Comprehensive Guide to the Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Unlocking the Secrets of Glynn County: A Comprehensive Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Secrets of Glynn County: A Comprehensive Guide to the Tax Map

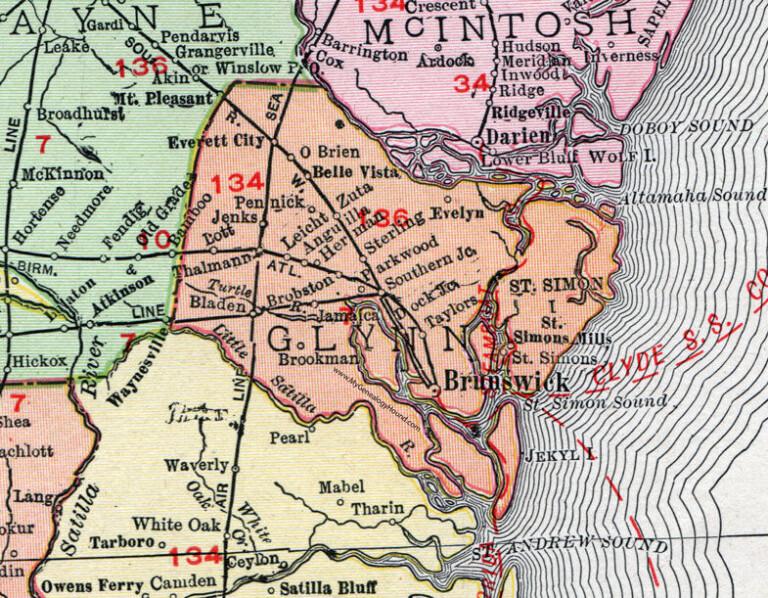

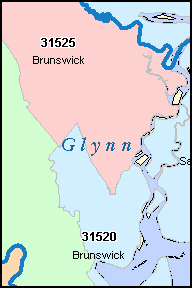

Glynn County, Georgia, a picturesque region known for its stunning coastline and vibrant culture, houses a treasure trove of information within its meticulously maintained tax map. This digital resource, accessible to the public, provides a detailed and comprehensive overview of property ownership and its associated tax data. This article delves into the intricacies of the Glynn County tax map, unveiling its significance and practical applications for diverse stakeholders.

Understanding the Glynn County Tax Map: A Foundation for Transparency

The Glynn County tax map serves as a digital blueprint, meticulously documenting every parcel of land within the county’s jurisdiction. Each parcel is assigned a unique identification number, facilitating easy access and retrieval of associated data. This data encompasses:

- Property Ownership: The map clearly identifies the legal owner of each property, providing valuable information for real estate transactions, property research, and legal proceedings.

- Property Boundaries: Precisely defined boundaries ensure accurate land measurements, preventing potential disputes and ensuring clarity in property ownership.

- Property Characteristics: The map outlines key property characteristics, including acreage, zoning classifications, and the presence of structures. This information is crucial for development planning, property valuation, and environmental assessments.

- Tax Information: The map integrates tax data, including assessed values, tax rates, and payment history. This transparency fosters accountability and allows property owners to track their tax obligations effectively.

Beyond the Basics: Exploring the Applications of the Tax Map

The Glynn County tax map’s utility extends beyond its primary function of documenting property details. Its multifaceted nature makes it a valuable resource for a wide range of individuals and organizations, including:

- Real Estate Professionals: Real estate agents, appraisers, and brokers rely heavily on the tax map to conduct property valuations, analyze market trends, and identify potential investment opportunities. The accurate and readily available data allows for informed decision-making and facilitates smooth transactions.

- Developers and Builders: The map’s detailed information on property characteristics, zoning regulations, and utility access serves as a vital tool for developers and builders. It enables them to assess feasibility, plan construction projects, and comply with local regulations.

- Government Agencies: County officials, planning departments, and emergency responders utilize the tax map for diverse purposes. It facilitates efficient land management, disaster preparedness planning, and the allocation of resources.

- Environmental Organizations: The tax map’s data on property boundaries and land use patterns assists environmental organizations in monitoring development activities, assessing ecological impacts, and advocating for conservation efforts.

- Community Members: The tax map empowers residents to gain insights into their neighborhood, understand property values, and engage in local planning initiatives. Its accessibility fosters community involvement and promotes transparency in land use decisions.

Navigating the Glynn County Tax Map: A Step-by-Step Guide

Accessing and interpreting the Glynn County tax map is a straightforward process, readily available to the public. Here’s a step-by-step guide to effectively utilize this valuable resource:

- Accessing the Tax Map: The Glynn County Tax Assessor’s website serves as the primary portal to the online tax map. Look for a dedicated section titled "Tax Map" or "Property Records."

- Searching for Properties: The website typically offers various search options, including property address, parcel number, owner name, or legal description. Enter the desired criteria to locate the specific property of interest.

- Viewing Property Details: Once the property is identified, click on the corresponding entry to access detailed information. This includes property ownership, boundaries, characteristics, and tax data.

- Visualizing the Map: Most online tax maps offer interactive features, allowing users to zoom in, pan, and explore the map. This visual representation provides a clear understanding of property locations and their surrounding areas.

- Downloading Data: Some websites allow users to download property data in various formats, such as PDF, CSV, or shapefiles. This enables further analysis and integration with other datasets.

FAQs about the Glynn County Tax Map

1. What is the purpose of the Glynn County tax map?

The Glynn County tax map serves as a comprehensive database of property ownership and related information, facilitating accurate property valuations, land management, and transparent tax administration.

2. Who can access the Glynn County tax map?

The Glynn County tax map is a public resource, accessible to anyone with an internet connection.

3. How can I find a specific property on the tax map?

The Glynn County Tax Assessor’s website offers various search options, including property address, parcel number, owner name, or legal description.

4. What information is available on the tax map?

The tax map provides information on property ownership, boundaries, characteristics, tax data, and other relevant details.

5. How often is the tax map updated?

The Glynn County tax map is updated regularly to reflect changes in property ownership, boundaries, and other relevant information.

6. Can I use the tax map for commercial purposes?

Yes, the tax map can be used for commercial purposes, such as real estate transactions, development planning, and market research. However, it’s important to ensure compliance with any applicable copyright or licensing agreements.

7. Is there a fee to access the tax map?

Access to the Glynn County tax map is generally free of charge. However, some services, such as data downloads or custom reports, may require a fee.

Tips for Using the Glynn County Tax Map Effectively

- Familiarize Yourself with the Website: Before embarking on a search, take the time to explore the Glynn County Tax Assessor’s website and understand its navigation and search functionalities.

- Utilize Multiple Search Options: Experiment with different search criteria to ensure you’re accessing the most relevant information.

- Verify Data Accuracy: While the tax map is generally accurate, it’s always prudent to double-check information with official records or property surveys.

- Consult with Professionals: For complex property inquiries or legal matters, consider consulting with a qualified real estate professional or attorney.

- Stay Updated: Regularly check for updates to the tax map to ensure you have access to the most current information.

Conclusion: Embracing the Power of Transparency

The Glynn County tax map stands as a testament to the importance of transparency and accessibility in public records. It empowers individuals, businesses, and government agencies to make informed decisions based on reliable data, fostering a more efficient and equitable land management system. By embracing this valuable resource, Glynn County residents and stakeholders can navigate the complexities of property ownership with confidence, ensuring a thriving and sustainable future for the region.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Secrets of Glynn County: A Comprehensive Guide to the Tax Map. We hope you find this article informative and beneficial. See you in our next article!