Unlocking the Secrets of Itawamba County: A Comprehensive Guide to the Tax Map

Related Articles: Unlocking the Secrets of Itawamba County: A Comprehensive Guide to the Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking the Secrets of Itawamba County: A Comprehensive Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Secrets of Itawamba County: A Comprehensive Guide to the Tax Map

The Itawamba County Tax Map serves as a vital tool for understanding the intricate web of property ownership and its associated financial obligations within the county. This comprehensive guide delves into the map’s intricacies, exploring its purpose, structure, and the valuable information it provides to residents, businesses, and government agencies alike.

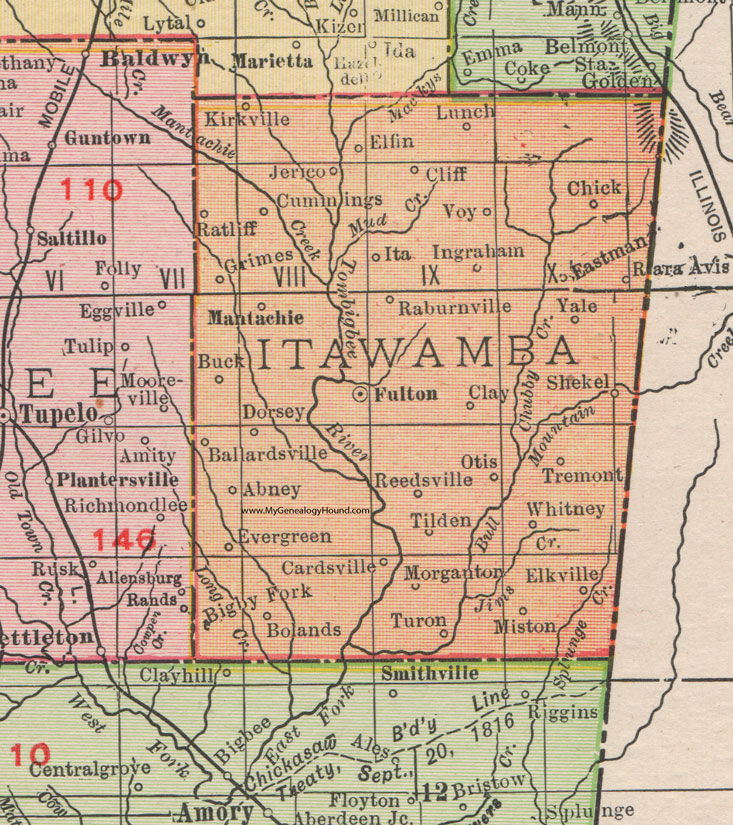

Understanding the Itawamba County Tax Map

The Itawamba County Tax Map is a meticulously detailed, geographically referenced database that outlines the ownership, boundaries, and assessed values of every parcel of land within the county. Its primary function is to provide a clear and standardized system for property identification and taxation.

Navigating the Map’s Structure

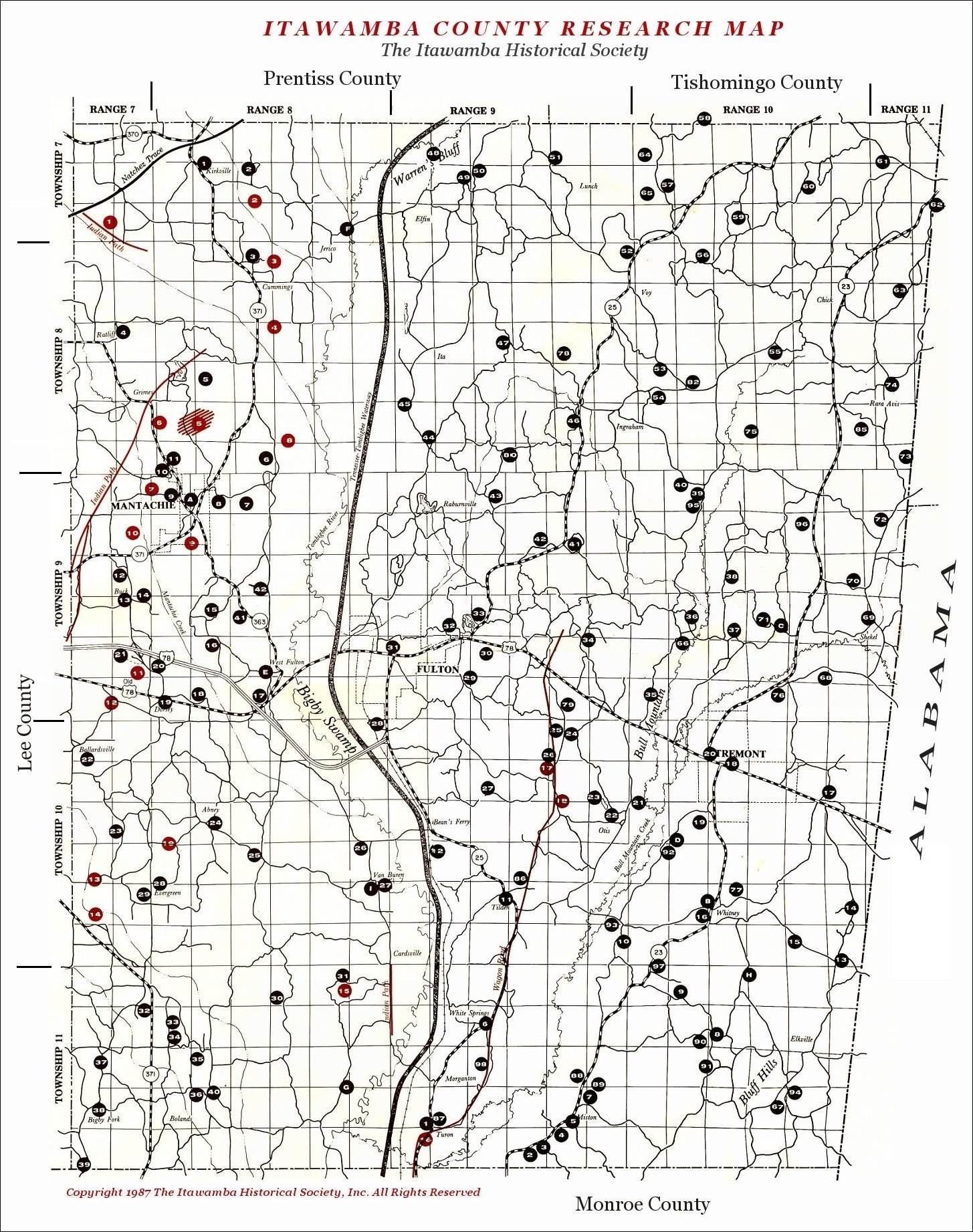

The Itawamba County Tax Map is organized in a hierarchical fashion, with each layer representing a specific level of detail:

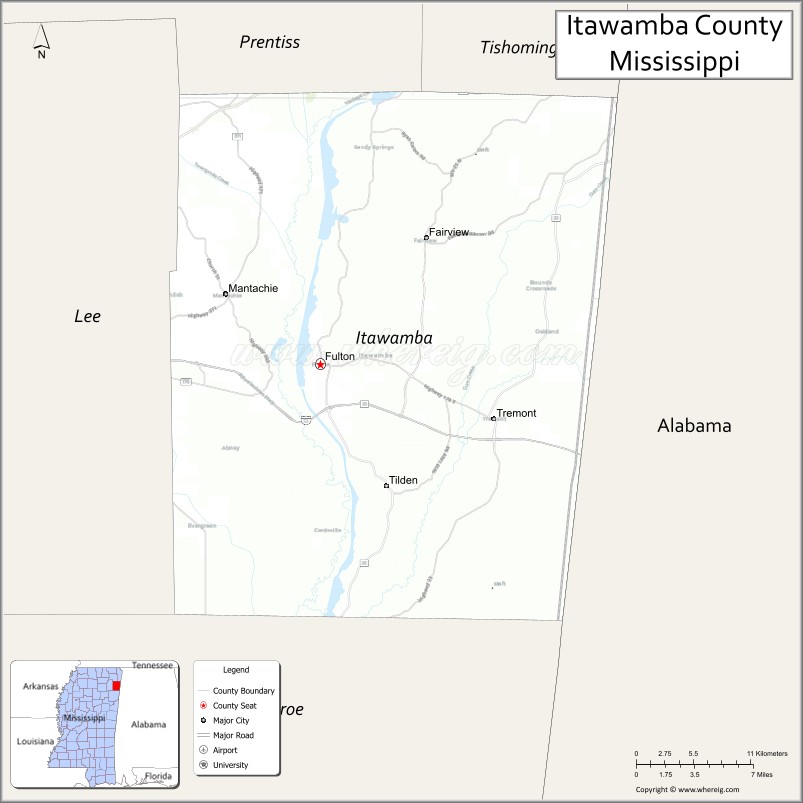

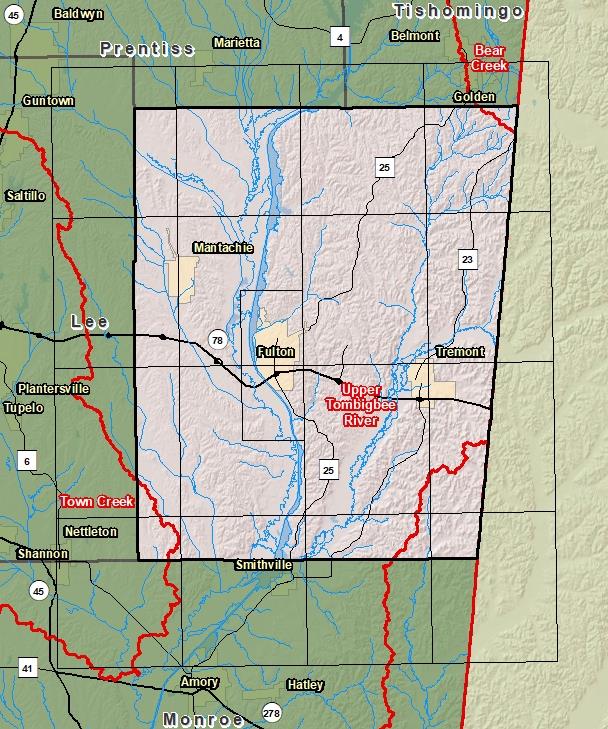

- County: The map encompasses the entirety of Itawamba County, providing a broad overview of property distribution.

- Township: The county is divided into townships, each containing a unique set of properties.

- Section: Within each township, sections are delineated, further subdividing the area into manageable units.

- Parcel: The most granular level of the map, parcels represent individual pieces of land with defined boundaries and ownership information.

Key Information Contained within the Map

The Itawamba County Tax Map provides a wealth of information about each parcel, including:

- Parcel Number: A unique identifier assigned to each parcel for easy reference.

- Owner Name and Address: The legal owner of the property is clearly identified.

- Property Address: The physical address associated with the parcel.

- Legal Description: A detailed description of the parcel’s boundaries, encompassing acreage, dimensions, and adjoining properties.

- Land Use: The primary use of the property is categorized, such as residential, commercial, agricultural, or industrial.

- Assessed Value: The estimated market value of the property, used for tax calculations.

- Tax Rate: The current tax rate applied to the property based on its classification.

- Tax Liability: The calculated amount of property taxes owed by the owner.

Accessing the Itawamba County Tax Map

The Itawamba County Tax Map is readily accessible to the public through various channels:

- Itawamba County Tax Assessor’s Office: The office provides in-person access to the map and its associated records.

- County Website: Many counties offer online versions of their tax maps, allowing users to search for specific parcels and retrieve information.

- Third-Party Websites: Several online platforms provide access to tax maps from various jurisdictions, including Itawamba County.

Benefits of Utilizing the Itawamba County Tax Map

The Itawamba County Tax Map offers numerous benefits to residents, businesses, and government agencies:

- Property Ownership Verification: The map serves as a reliable source for confirming property ownership and boundaries.

- Tax Assessment Transparency: The map provides clear insight into the assessment process and the factors influencing property valuations.

- Real Estate Transactions: Buyers, sellers, and real estate professionals utilize the map to understand property details and assess potential investments.

- Land Planning and Development: Developers and planners rely on the map to identify available land, understand zoning regulations, and plan future projects.

- Emergency Response: The map assists emergency responders in locating properties quickly and efficiently during emergencies.

- Property Value Disputes: The map provides valuable information for resolving disputes regarding property values and tax assessments.

Frequently Asked Questions (FAQs) about the Itawamba County Tax Map

Q: How do I find information about a specific property on the Itawamba County Tax Map?

A: You can access the map online through the Itawamba County website, the Tax Assessor’s Office, or third-party platforms. Simply search for the property’s address or parcel number to retrieve the relevant information.

Q: What if I believe my property’s assessed value is inaccurate?

A: You can file an appeal with the Itawamba County Board of Equalization. The Board reviews appeals and adjusts property values based on evidence and market data.

Q: How can I update my contact information on the tax map?

A: Contact the Itawamba County Tax Assessor’s Office to update your name, address, or other relevant information.

Q: What are the different tax classifications used in Itawamba County?

A: The Itawamba County Tax Assessor’s Office maintains a list of tax classifications, including residential, commercial, agricultural, and industrial. Each classification is subject to a specific tax rate.

Q: How do I pay my property taxes in Itawamba County?

A: Property taxes are typically paid to the Itawamba County Tax Collector’s Office. Payment methods may include online, mail, or in person.

Tips for Utilizing the Itawamba County Tax Map Effectively

- Familiarize Yourself with the Map’s Structure: Understanding the map’s hierarchy and key features will enhance your navigation and information retrieval.

- Utilize Search Functions: Online map platforms often offer advanced search functions for finding properties by address, parcel number, or other criteria.

- Review Property Information Carefully: Scrutinize the details provided for each parcel, including ownership, boundaries, and assessed values.

- Contact the Tax Assessor’s Office for Assistance: If you encounter difficulties or have questions, the Tax Assessor’s Office is a valuable resource for guidance and support.

Conclusion

The Itawamba County Tax Map serves as an essential tool for navigating the complexities of property ownership and taxation within the county. By providing a comprehensive and standardized framework for property identification, assessment, and ownership information, the map empowers residents, businesses, and government agencies to make informed decisions, ensure transparency, and maintain efficient land management practices. As a vital resource for understanding the county’s property landscape, the Itawamba County Tax Map remains a cornerstone of effective governance and responsible land stewardship.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Secrets of Itawamba County: A Comprehensive Guide to the Tax Map. We appreciate your attention to our article. See you in our next article!